Churn Rate

Introduction to churn rate

Churn rate is a critical metric that measures the percentage of customers who stop using a product or service over a specific period. High churn rates indicate that customers are leaving at a significant rate, which can be a red flag for underlying issues with the product, customer experience, or value proposition. On the other hand, a low churn rate suggests strong customer retention and satisfaction. Understanding and managing churn rate is essential for long-term business growth and stability. A good prediction of the churn rate is essential for businesses because it enables proactive retention strategies, minimizing revenue loss and maximizing customer lifetime value.

This page explores the importance of churn rate, how to calculate it, and strategies to reduce churn and improve customer retention.

Table of content

- Introduction to churn rate

- Why churn rate matters

- How to measure churn rate

- Churn rate calculation formula

- Types of churn

- 1. Voluntary vs. involuntary churn

- 2. Customer vs. revenue churn

- Best practices for churn rate measurement and prediction

- 1. Segment churn data

- 2. Track churn over time

- 3. Churn rate prediction and analysis

- Strategies to reduce churn

- 1. Improve onboarding

- 2. Enhance customer support

- 3. Increase product engagement

- 4. Implement customer success programs

- 5. Address involuntary churn

- Challenges in reducing churn

- 1. Identifying root causes

- 2. Balancing acquisition and retention

- Related topics

Why churn rate matters

Churn rate is important for several reasons:

- Customer retention: High churn indicates a problem with retaining customers, which can severely impact revenue and profitability.

- Business growth: Reducing churn is often more cost-effective than acquiring new customers, making it a key factor in sustainable growth.

- Customer feedback: Churn rate serves as a form of feedback, signaling whether customers are satisfied and finding value in your product or service.

- Forecasting: Churn rate is a vital input for forecasting future revenue and planning customer success strategies.

Monitoring and managing churn rate helps businesses understand customer behavior, address issues proactively, and foster long-term customer relationships.

How to measure churn rate

Churn rate is typically measured as the percentage of customers who leave during a specific period compared to the total number of customers at the beginning of that period.

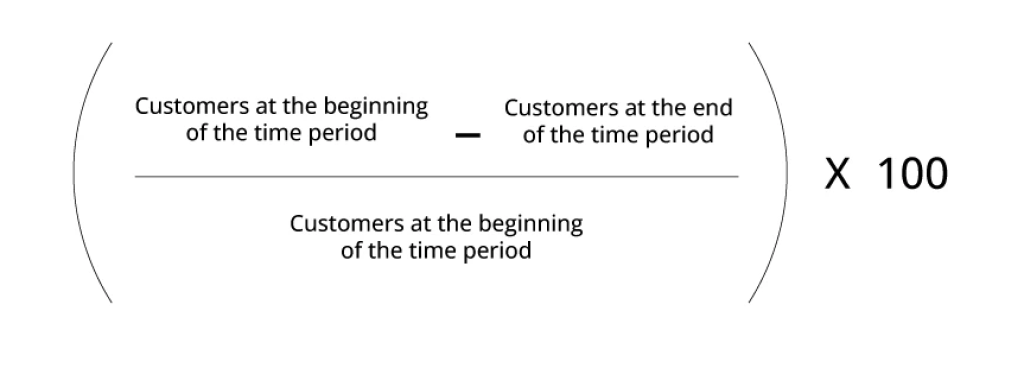

Churn rate calculation formula

The basic formula for calculating churn rate is:

Churn Rate = (Number of Customers Lost During the Period / Total Number of Customers at the Start of the Period) ×100

Number of customers lost: The total number of customers who stopped using your product or service during the period.

- Total number of customers: The number of customers at the start of the period.

Example calculation:

If you started the month with 1,000 customers and lost 50 by the end of the month, the churn rate would be:

Churn Rate = (50 / 1000) × 100 = 5%

A 5% churn rate means that 5% of your customers left during that month.

Types of churn

Churn can manifest in different ways, and understanding the type of churn is crucial for addressing it effectively.

1. Voluntary vs. involuntary churn

- Voluntary churn: Customers actively choose to leave, often due to dissatisfaction, lack of perceived value, or a switch to a competitor.

- Involuntary churn: Customers are lost due to factors beyond their control, such as payment failures or service disruptions. This type of churn can sometimes be mitigated with operational improvements.

2. Customer vs. revenue churn

- Customer churn: Measures the percentage of customers lost, regardless of their revenue contribution.

- Revenue churn: Focuses on the revenue lost from churned customers, which is particularly important for subscription-based businesses where high-revenue customers may have a disproportionate impact.

Understanding these types helps tailor strategies to address the specific causes of churn in your business.

Best practices for churn rate measurement and prediction

Accurately measuring churn rate involves not only capturing the raw data but also interpreting it in the context of your business model and customer base.

1. Segment churn data

Different customer segments may have different churn rates. Segmenting your churn data can provide more actionable insights.

Best practices:

- Customer segmentation: Break down churn rates by customer segment, such as by demographics, purchase behavior, or product usage, to identify at-risk groups.

- Plan-Based segmentation: For subscription businesses, segment churn by pricing plan to see if certain tiers have higher churn rates.

2. Track churn over time

Churn rates can fluctuate based on seasonality, product changes, or marketing efforts. Tracking churn over time helps identify trends and patterns.

Best practices:

- Monthly/Quarterly analysis: Regularly track churn rates on a monthly or quarterly basis to monitor changes and trends.

- Historical benchmarking: Compare current churn rates to historical data to assess whether your retention strategies are improving or if new issues have emerged.

3. Churn rate prediction and analysis

Understanding why customers churn is critical for developing effective retention strategies.

Best practices:

- Exit surveys: Implement exit surveys to gather feedback from customers who leave, focusing on their reasons for churning.

- Behavioral analysis and product usage: Use data analytics to identify common behaviors or patterns among churned customers, such as declining usage or engagement before leaving.

- Customer support interactions: Frequent or unresolved support requests can be a signal of dissatisfaction.

Strategies to reduce churn

Reducing churn requires a proactive approach, focusing on improving customer satisfaction, engagement, and the overall value proposition.

1. Improve onboarding

A smooth and effective onboarding process can significantly reduce churn by ensuring that customers understand how to use your product and see its value early on.

Best practices:

- Personalized onboarding: Tailor the onboarding process to the specific needs and goals of each customer segment, offering guided tutorials, resources, and support.

- Early value delivery: Focus on delivering immediate value during onboarding, helping customers achieve quick wins that reinforce the benefits of your product.

Find out more about Onboarding and Implementation Management ->

2. Enhance customer support

High-quality, responsive customer support is essential for resolving issues before they lead to churn.

Best practices:

- Proactive support: Implement proactive support strategies, such as reaching out to customers who show signs of disengagement or frustration.

- Multichannel availability: Offer support through multiple channels (e.g., phone, chat, email) to meet customers where they are most comfortable.

Find out more about Customer Support ->

3. Increase product engagement

Engaged customers are less likely to churn. Focus on strategies that increase product usage and integration into customers’ daily workflows.

Best practices:

- Usage analytics: Use analytics to track customer engagement and identify users who are at risk of churning due to low activity or irregular usage.

- Feature adoption campaigns: Promote the adoption of key product features that drive engagement and provide additional value to customers.

4. Implement customer success programs

Customer Success programs are designed to help customers achieve their goals, increasing their satisfaction and reducing the likelihood of churn.

Best practices:

- Regular check-ins: Schedule regular check-ins with customers to review their progress, address concerns, and offer additional resources.

- Success plans: Develop customized success plans for high-value customers, outlining key milestones and metrics to ensure they derive maximum value from your product.

Find out more about user adoption ->

5. Address involuntary churn

Involuntary churn, such as that caused by payment failures, can often be mitigated with operational improvements.

Best practices:

- Payment recovery: Implement automated payment recovery processes, such as retrying failed payments and sending reminders before payment methods expire.

- Service reliability: Ensure that your service is reliable and that any outages or disruptions are quickly addressed to prevent customers from churning due to technical issues.

Challenges in reducing churn

Reducing churn is challenging, especially in competitive markets or for complex products. However, by understanding these challenges, businesses can develop more effective strategies.

1. Identifying root causes

Churn can result from a wide range of factors, making it difficult to pinpoint the exact causes.

Helpful strategies

- Comprehensive feedback collection: Gather feedback from multiple sources, including exit surveys, customer support interactions, and usage data, to identify the root causes of churn.

- Data-driven insights: Use advanced analytics to correlate churn with specific customer behaviors or product features, helping to isolate the most significant factors.

2. Balancing acquisition and retention

Focusing too heavily on either customer acquisition or retention can create an imbalance, potentially leading to higher churn rates.

Helpful strategies:

- Integrated atrategy: Develop an integrated strategy that balances efforts across acquisition, retention, and customer success, ensuring that new customers are effectively onboarded and engaged.

- Resource allocation: Allocate resources effectively between marketing, sales, and customer success teams to support both growth and retention goals.

Related topics

Want to get in touch? Leave us a message.

If you want to learn more about VENMATE and customer success management, feel free to get in touch and request a demo.